27+ Chapter 6 A Of Income Tax

TDS rates under DTAA. 1 This Chapter has effect with respect to the provision of services through an intermediary F2 in a case where the services are provided to a person who is not a public authority and who either a qualifies as small for a tax year or b does not have a UK connection for a tax year.

Pdf Challenges Of Direct Tax Code 2010 Over Income Tax Act 1961

127 It is a further requirement.

. This section needs expansion. Web Malaysia business and financial market news. Web Comprising All Public Laws through the 122nd Indiana General Assembly Second Regular Session Second Regular Technical Session and Special Session 2022.

Owner of house property annual charge etc defined. Tax rates as per Income-tax Act vis-à-vis tax treaties. The Star Online delivers economic news stock share prices personal finance advice from Malaysia and world.

Web The Business Journals features local business news from 40-plus cities across the nation. Federal government websites often end in gov or mil. 13 As noted in 11 child care expenses must be incurred in respect of an eligible child of the taxpayer.

A child who is dependent on the taxpayer or on the taxpayers spouse or. Title II 201a Dec. The Low-Income Housing Tax Credit LIHTC offers developers nonrefundable and transferable tax credits to subsidize the construction and rehabilitation of housing developments that have strict income limits for eligible tenants and their cost of housing.

You can help by adding to it. These supplemental H-2B visas are for US. An eligible child of a taxpayer for a tax year is defined in subsection 633 to mean.

August 2013 Multiple conflicting theories. 2E Omitted by. Web Regulation EU 2016679 of the European Parliament and of the Council of 27 April 2016 on the protection of natural persons with regard to the processing of personal data and on the free movement of such data and repealing Directive 9546EC General Data Protection Regulation Text with EEA relevance.

Web Chapter 4 discusses income tax benefits that apply if you meet certain requirements while living abroad. Web 1 The protection of natural persons in relation to the processing of personal data is a fundamental right. Eight states impose no state income tax.

Before sharing sensitive information make sure youre on a federal government site. AFS was a file system and sharing platform that allowed users to access and distribute stored content. Web Andrew File System AFS ended service on January 1 2021.

Web The Hall income tax was a Tennessee state tax on interest and dividend income from investments. Then the taxpayers tax under this chapter for the taxable year shall be increased by the credit recapture amount. Web An income tax is a tax imposed on individuals or entities taxpayers in respect of the income or profits earned by them.

BIT Business-income tax as defined in subsection 1267. Web Key Findings. Substituted by the IT Eleventh Amdt.

This chapter discusses the income tax treatment of various types of educational assistance you may receive if you are studying. The LIHTC has subsidized over 3 million housing units since it was. Article 81 of the Charter of Fundamental Rights of the European Union the Charter and Article 161 of the Treaty on the Functioning of the European Union TFEU provide that everyone has the right to the protection of personal.

A Subject to the provisions of subsection B for taxable years beginning after 1994 a tax is imposed on the South Carolina taxable income of individuals estates and trusts and any other entity except those taxed or exempted from taxation under Sections 12-6. For this data the variance of GDP per capita with purchasing power parity PPP is explained in 27 by tax revenue. A child of the taxpayer or of the taxpayers spouse or common-law partner.

Transfer Pricing as contained in Chapter X of Income-tax Act 1961. CAP applies a racial equity lens in developing and advancing policies that root out deeply entrenched systemic racism to ensure everyone has an opportunity to. We also provide tools to help businesses grow network and hire.

Transfer of income where there is no transfer of assets. Profits and gains of business or profession. Forty-two states and many localities in the United States impose an income tax on individuals.

Employers seeking to petition for additional workers at certain periods of the fiscal year before Sept. AFS was available at afsmsuedu an. Including for fraud and tax.

It was the only tax on personal income in Tennessee which did not levy a general state income taxThe tax rate prior to 2016 was 6 percent applied to all taxable interest and dividend income over 1250 per person 2500 for married couples filing. Web Employer-provided educational assistance benefits include payments made after March 27 2020 and before January 1 2026 for principal or interest on any qualified education loan you incurred for your education. Web The gov means its official.

Web Application of this Chapter UK. Web This Folio Chapter provides tax professionals businesses and individuals with a technical overview of the Canada Revenue Agencys position on the deductibility of interest expense under paragraph 201c. You may qualify to treat up to 108700 of your income as not taxable by the United States.

Profits chargeable to tax. 48 Scope of this Chapter UK. 14 The following abbreviations and definitions are used in this Chapter.

Web Among people aged 2574 years living in the EU in 2021 more than one fifth 221 had completed at most lower secondary education close to half 465 had a medium level of education ie. Web Advancing Racial Equity and Justice. States collect a state income taxSome local governments also impose an income tax often based on state income tax calculations.

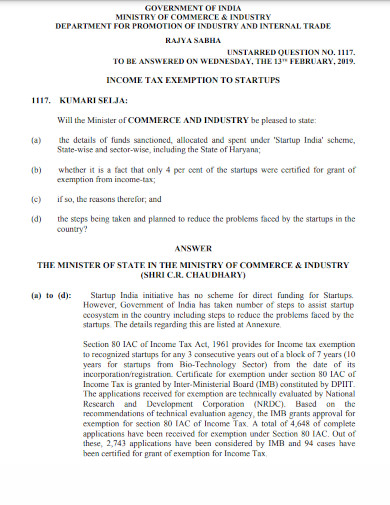

INCOME OF OTHER PERSONS INCLUDED IN ASSESSEES TOTAL INCOME. Web individuals legislation at sections 413 to 430 Income Tax Act 2007 companies legislation at sections 191 to 202 Corporation Tax Act 2010. Web The Income Tax Department NEVER asks for your PIN numbers.

Chapter 327 Keeping Gift Aid records. Web The Department of Homeland Security and the Department of Labor are issuing a temporary final rule that makes available 64716 additional H-2B temporary nonagricultural worker visas for fiscal year FY 2023. Tax rates for individuals estates and trusts for taxable years after 1994.

Form No2E PDF Omitted FORM NO. 50 of the social security tax imposed on net earnings from self-employment earned during the period beginning on March 27 2020 and ending. Web No Federal income tax benefit shall fail to be allowable to the taxpayer with respect to any qualified low-income building merely by reason of a right of 1st refusal held by the.

CTOPa Canadian tax otherwise payable as calculated under paragraph a of the subsection 1267 definition of the term tax for the year otherwise payable under this Part. Web Abbreviations and definitions used. Web In addition to federal income tax collected by the United States most individual US.

Either upper secondary or post-secondary non-tertiary education and close to one third 314 had a tertiary educational attainment see Figure 1. Also discussed are various other provisions of the Act relating to interest deductibility.

Simulation Design For Policy Audiences Informing Decision In The Face Of Uncertainty Springerlink

Instructor S Manual Ateneonline

Deduction Under Chapter Vi A How Much Can I Deduct Under Chapter Vi A

Pdf How Much Can We Trust Different E Government Surveys The Case Of Slovenia

Income Tax Accounting Example Of Income Tax Accounting

Tax Exemption Examples Pdf Examples

Income Tax Act 1961 Basics That You Need To Know

Progressive Tax Example And Graphs Of Progressive Tax

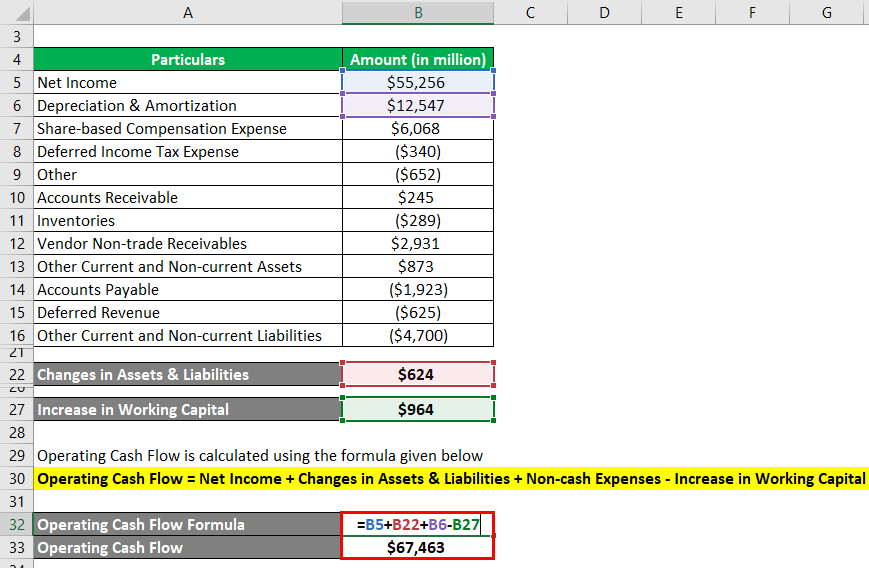

Operating Cash Flow Formula Examples With Excel Template Calculator

Pdf Labour Migration From Eap Countries To The Eu Assessment Of Costs And Benefits And Proposals For Better Labour Market Matching Martin Kahanec Academia Edu

Get Income Tax Act 1961 Microsoft Store

Analytical View Of Section 139 Of Income Tax Act 1961

What Are The Deductions Available Under Chapter Vi A Of Income Tax Act Individuals And Huf Youtube

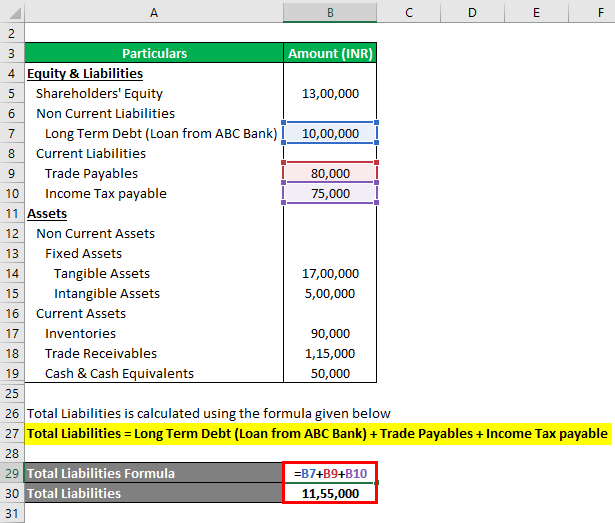

Net Asset Formula Examples With Excel Template And Calculator

Income Tax Act 1961 Basics That You Need To Know

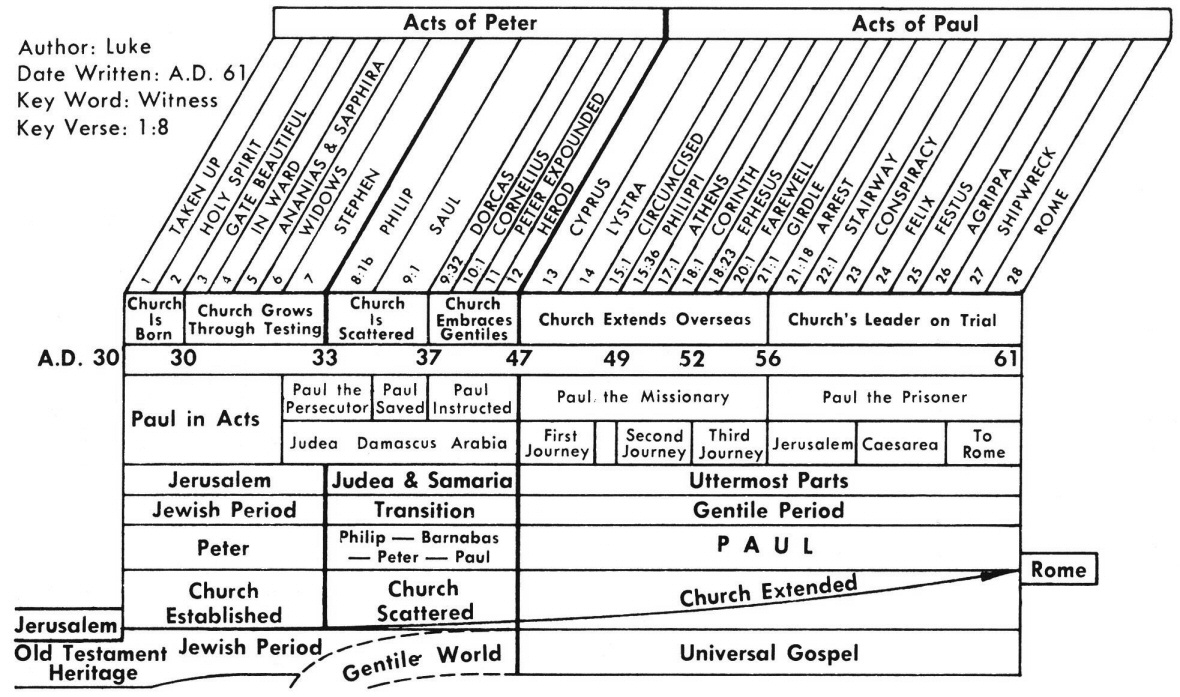

Acts 5 Commentary Precept Austin

Tax Shield How Does Tax Shield Save On Taxes Uses Of Tax Shield